A scenario-based risk assessment framework as the backbone of our climate risk analytics tool

Our integrated and flexible architecture allows to understand how climate risk might impact investment portfolios and banks’ financial assets, considering the whole array of climate risk components.

Transition Risk

The potential financial losses that can arise from the process of adjusting to a low-carbon economy. The intensity of the transition efforts are measured by the decrease in aggregate greenhouse gas emissions.

Physical Risk

The direct and tangible consequences of climate-related events on ecosystems and economies. It can be categorized into acute risk (immediate and severe consequences of extreme weather events) and chronic risk (associated with the long-term, gradual impacts of sustained changes in climate patterns).

Nature Risk

The potential financial and operational risks that arise from a company’s dependencies and impacts on the natural environment, including biodiversity, ecosystems, land, water, and natural resources.

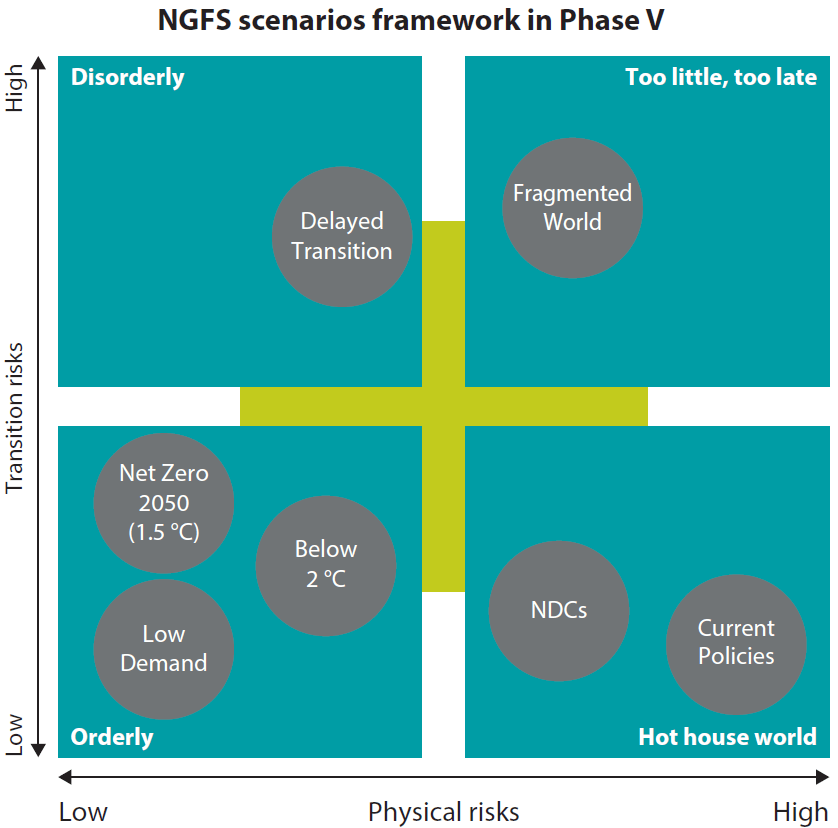

Climate scenarios at the heart of our prediction engine

Built by trusted organizations, they help us exploring how the world might evolve in the medium-to-long term*

Climate scenarios allow us to translate complex climate science into valuable economic and financial insights

* Based on a different set of assumptions

We adopt globally recognized science-based framework developed by the Network for Greening the Financial System

Developed by central banks and supervisors, NGFS scenarios model how climate risks could impact the economy under varying assumptions about policy action, technology, and physical risks.

They support consistent, forward-looking climate risk analysis, and enable the interplay between transition and physical risk over time.

Net Zero 2050

Temperature target

1.4 °C

Policy reaction

Immediate and smooth

Technological change

Slow/Fast

Ambitious climate policies are introduced immediately. Net CO2 emissions reach zero around 2050, giving at least a 50 % chance of limiting global warming to below 1.5 °C by the end of the century. Physical risks are relatively low but transition risks are high.

Delayed Transition

Temperature target

1.7 °C

Policy reaction

Delayed and abrupt

Technological change

Slow/Fast

New climate policies are not introduced until 2030. A strong policy action is then needed to reduce CO2 emissions abruptly, in the attempt to limit global warming to below 2 °C with a 67 % chance. Transition and physical risks are higher than Net Zero 2050.

Current policies

Temperature target

3.0 °C

Policy reaction

No reactions

Technological change

Slow

Only currently implemented policies are preserved, resulting in a virtually absent transition risk. CO2 emissions grow until 2080 leading to about 3 °C of warming and severe physical risks. This includes irreversible changes like higher sea level rise.

Seamless integration into standard risk assessment frameworks

We assess how climate risks influence creditworthiness by modeling their impact on default probabilities

Clear and actionable estimates eliminate the need for additional processing and complex interpretation

Corporates and Households

Our framework is specifically designed to assess and quantify climate-related financial losses for portfolios comprising both corporates and households.

Recognizing the fundamentally different nature of these two sectors, we apply distinct analytical approaches to ensure accuracy and relevance in the risk assessment.